Competitive Exness Fees: An In-Depth Look

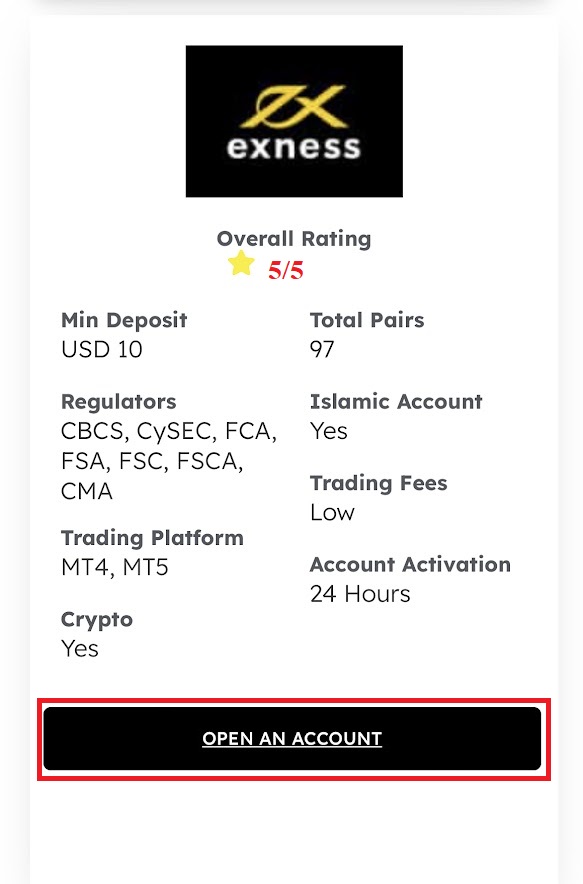

In the dynamic world of online trading, understanding the fees associated with your trading platform is crucial for optimizing your profitability. Competitive Exness Fees http://genki-maker.com/?p=3419 Exness is one of the brokers that has garnered attention for its competitive fee structure, which can significantly impact trading strategies. In this article, we will delve into the various facets of Exness fees, comparing them to industry standards, and offering insights on how they affect traders’ choices.

What Are Exness Fees?

Exness fees refer to the costs incurred by traders when executing trades using the Exness trading platform. These fees can come in several forms, including spreads, commissions, overnight fees, and withdrawal charges. Understanding these fees is vital for traders to manage their costs effectively and ensure that their strategies remain profitable over time.

Types of Exness Fees

Spreads

One of the most common types of fees traders encounter is the spread, which is the difference between the buying and selling price of an asset. Exness provides a variety of account types, each with its spread structure. For instance, the Standard account features variable spreads starting from 0.3 pips, while the Raw Spread account offers spreads that can go down to as low as 0.0 pips but includes a commission fee.

Commissions

Depending on the account type selected, Exness charges commissions for certain trading activities. The Raw Spread account, for example, charges a commission of $3.50 per side for each standard lot traded. This fee structure is particularly beneficial for high-volume traders who prefer tighter spreads.

Overnight Fees

Also known as swap fees, overnight fees are charged when a position is held overnight. Exness applies different overnight fees based on the asset and the direction of the trade. These fees are an essential consideration for traders who expect to hold their positions longer than a single trading day.

Withdrawal Fees

While many brokers impose withdrawal fees, Exness stands out with its relatively low costs. Currently, Exness does not charge withdrawal fees for most payment methods, which is a significant advantage for traders aiming to maximize their profits. However, it is still crucial to check the specific policies of the chosen payment method since third-party processors may impose their fees.

Comparing Exness Fees with Competitors

When assessing any trading platform, it’s essential to compare its fees against competitors. Exness’s fee structure is competitive when compared to other popular brokers. For example, while some brokers offer zero commissions but have high spreads, Exness’s balance of lower spreads and reasonable commissions can be more appealing for specific trading strategies.

Furthermore, Exness’s transparency regarding its fees is commendable. Traders can quickly access and understand the costs associated with their trading, facilitating better financial planning.

Implications of Competitive Fees on Trading Strategies

The structure of Exness fees directly influences traders’ strategies. For instance, high-frequency traders may prefer account types with tighter spreads and are willing to pay commissions to maintain low overall trading costs. On the other hand, long-term investors might prioritize accounts with lower spreads and no commission, especially if they plan to hold positions for an extended period.

Understanding the fee implications can help traders design strategies that mitigate costs. For example, using limit orders during low volatility periods can ensure tighter spreads and minimize execution costs.

Final Thoughts

In conclusion, understanding competitive Exness fees is essential for all traders looking to enhance their profitability. The combination of transparent fee structures, a variety of account types, and competitive comparison against other brokers contributes to a trader-friendly environment at Exness. By carefully evaluating these fees and incorporating them into overall trading strategies, traders can make informed decisions that align with their financial goals. As always, it’s advisable to thoroughly assess personal trading style and preferences before choosing the right account type and strategy.

For more information regarding trading fees and strategies, consider exploring further resources to keep yourself updated in the ever-evolving landscape of online trading.