Exness Minimum Deposit: What You Need to Know

The forex market has become increasingly popular over recent years, leading many traders to explore broker options for managing their investments. Among various brokers, Exness stands out due to its competitive features and low barrier for entry. In this article, we will discuss the Exness Minimum Deposit https://broker-bixbite.com/deposit-minimum-exness/ and its implications for both novice and experienced traders.

What is Exness?

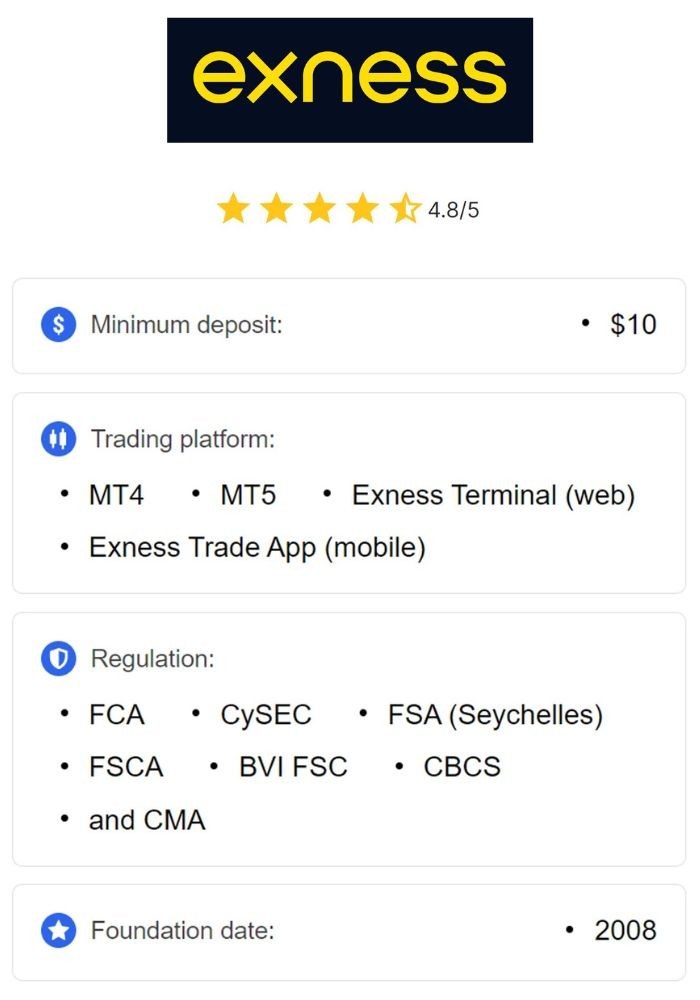

Exness is an online brokerage that allows traders to engage in forex and CFD trading. Established in 2008, the broker has built a reputation for its user-friendly platform, competitive spreads, and impressive leverage options. Exness offers a variety of trading instruments, including forex pairs, commodities, crypto, and indices, making it a versatile choice for traders of all levels.

Understanding Minimum Deposit

The minimum deposit is the smallest amount of money a trader needs to open an account with a broker. This amount can vary significantly between brokers and account types. Understanding the minimum deposit can help you assess your budget and trading approach. It is especially important for new traders who are still exploring their trading strategies.

Exness Minimum Deposit Requirements

Exness has set its minimum deposit requirements to cater to a wide range of traders. The minimum deposit can be as low as $1 depending on the account type. Here are the different account types offered by Exness and their respective minimum deposit requirements:

- Standard Account: Minimum deposit of $1.

- Pro Account: Minimum deposit of $200.

- Raw Spread Account: Minimum deposit of $500.

- Zero Account: Minimum deposit of $100.

Benefits of Low Minimum Deposit

The low minimum deposit is one of the significant advantages of trading with Exness. Here are some of the benefits:

- Accessibility: A low minimum deposit makes trading accessible to a broader audience, allowing new traders to enter the market without significant financial commitment.

- Risk Management: It allows traders to test their strategies with a limited amount of money, reducing the overall risk involved in trading.

- Flexibility: Traders can choose to invest more as they gain confidence and experience in the market, rather than committing a large sum upfront.

Withdrawal and Deposit Options at Exness

Exness provides various deposit and withdrawal methods, making transactions easy and accessible for traders worldwide. You can deposit using methods such as:

- Bank Transfer

- Credit and Debit Cards (Visa, Mastercard)

- Electronic Wallets (Skrill, Neteller, WebMoney)

- Cryptocurrencies

Withdrawal options are also diverse, ensuring that traders can manage their funds efficiently. Processing times can vary depending on the method chosen, but many options are instant or near-instant.

Considerations Before Depositing

Before making a deposit with Exness, traders should consider the following:

- Account Type: Choose an account type that aligns with your trading objectives. Each account has different features and spreads adjusted for the deposit amounts.

- Leverage: Understand that higher leverage expands opportunities but also increases risk levels.

- Trading Strategy: Select a strategy that suits your style, whether it involves day trading, swing trading, or long-term investments.

Conclusion

Exness stands out as a leading forex brokerage with low minimum deposit requirements, making it an attractive choice for traders at all experience levels. With a starting capital as low as $1, anyone can explore the world of trading without a significant financial commitment. It’s crucial to understand the various account types and the implications of choosing one over another. Always take the time to research and plan your trading strategy properly before diving into the market. Ultimately, Exness provides a user-friendly platform with diverse options and low barriers that can empower both new and seasoned traders to navigate the ever-changing financial markets confidently.